Long-Term Care Insurance Coverage

Preserve assets and plan for the future with TASB Benefits Long Term Care Insurance coverage.

What Is Long-Term Care Insurance?

Long-term care (LTC) insurance helps cover the costs of services and support for individuals who need assistance with daily activities due to chronic illness, disability, or aging. This type of insurance applies to care generally not covered by health insurance, Medicare, or Medicaid. Without it, personal assets must be used to pay the costs, quickly depleting a lifetime of savings.

Through the TASB Benefits Cooperative, school districts in Texas can provide employees with access to LTC insurance and other health-related benefits.

Why Offer LTC Insurance to Employees?

The Costs of Caregiving

Long-term care planning remains a largely overlooked benefit within many school systems. By offering an LTC insurance option, districts can help employees lessen the financial, mental, and physical burdens on caregivers in high-stress careers such as education. Supporting employees with this option shows a commitment to their well-being and future security.

Learn more about the importance of long-term care planning by reading, “Be an Innovator: Address the Need for Long-Term Care Planning”

Genworth Cost of Care Survey, 2023

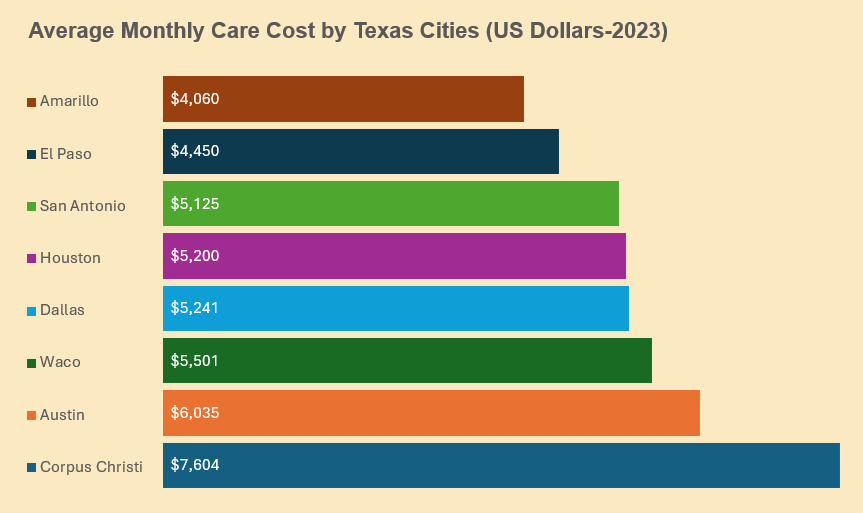

The Cost of Care in Texas

Calculate the cost of care in your area.

Total prices vary based on level of care, accommodation type, and city, but the average monthly costs for long-term care in Texas are significant (Genworth Cost of Care Survey, 2023):

- Home Health Aide: $5,339

- Assisted Living: $4,915

Planning for Long-Term Care

Without insurance, paying for long-term care can drain personal resources quickly. Consider these options:

- Medicaid and Medicare: Limited coverage, with strict income or age requirements

- Personal Savings: Costs can escalate rapidly, leaving little for family needs

Why Districts Should Choose TASB Benefits Cooperative

With the TASB Benefits Cooperative, school districts can easily provide LTC insurance to employees with no additional cost to the district. Here’s why it’s a smart choice:

- Simplified Procurement: TASB Benefits Cooperative issued a formal RFP for long-term care coverage and has awarded providers that are available to schools via the TASB Benefits Cooperative interlocal agreement. Click here to view more information on joining the TASB Benefits Cooperative.

- Flexible Enrollment Options: Off-cycle open enrollments, with or without payroll deduction.

- Time-Saving Administration: Minimal administrative time required for setup and management.

- Zero-Cost Program for Districts: Districts can offer this benefit without incurring additional expenses.

- Educational Group Meetings: Depending on your district’s circumstances, educational group meetings are offered at times convenient to district staff and employees.

- FREE Monthly Carrier/Payroll Medical Plan Billing Reconciliation: Offered to districts during their participation in the LTC program through TASB Benefits Cooperative and First Public. Offer available for a limited time.

Benefits for Employees

- Eligible employees can purchase coverage for themselves, or themselves and an eligible spouse

- Employees can bring their fully portable policy with them if they leave the district

- Up to a $100k guarantee issuance per employee for LTC insurance (certain limitations may apply)

- Not a “use it or lose it” policy - covers long-term care needs while keeping full life insurance benefits if LTC isn't used

Ready To Support Your Employees’ Futures?

Contact the TASB Benefits Cooperative team today to learn more about offering your district employees the opportunity to plan and secure their financial stability.